many beginner investors fall victim to fraudulent trading companies. These companies exploit the lack of experience of new traders, leading to significant financial losses. Fortunately, recovering funds from such companies has become easier thanks to services like those offered by “Sari” Office, a specialist in retrieving trading funds.

Understanding the Risks of Fraudulent Trading Companies

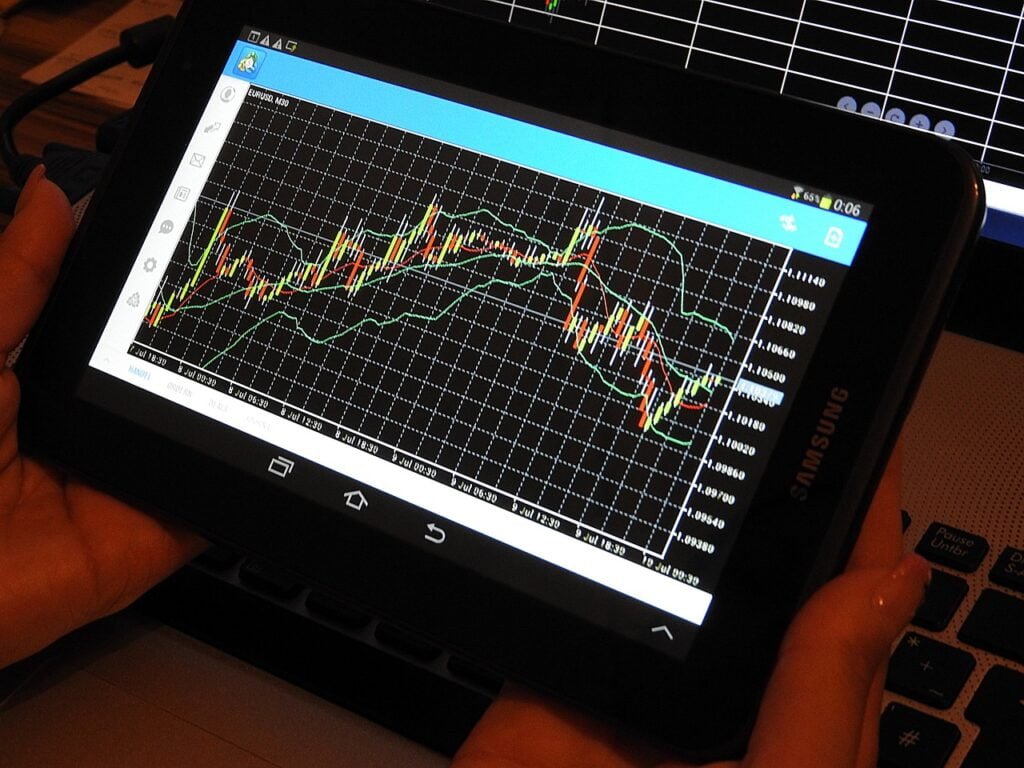

Fraudulent trading companies operate in various ways to deceive investors, such as promising high returns in a short period or manipulating data and prices. Often, these companies are unlicensed and lack transparency, making it difficult for investors to verify their legitimacy. This phenomenon is especially prevalent in the UAE, making it essential to take precautions to safeguard investments.

Steps to Recover Funds from Fraudulent Trading Companies

If you’ve fallen victim to a fraudulent trading company, here are the steps you can take to recover your funds:

- Direct Contact with the Company

Start by reaching out to the company and requesting a refund. They may have specific procedures for this. - Contact Your Bank or Payment Provider

If the company does not respond, contact the bank you used for the transactions. Banks can often assist in recovering funds, especially if the fraud is reported within a specific timeframe. - File a Police Report

If the previous steps fail, file a formal complaint with your local police station. This initiates an official investigation and can increase your chances of recovering your money. - Report to the Securities and Commodities Authority

In the UAE, you can lodge a complaint with the Securities and Commodities Authority (SCA), providing evidence and documentation of the fraud.

How Sari Office Can Help Recover Funds

“Sari” Office specializes in assisting victims of trading fraud and provides comprehensive services, including:

- Legal Consultation

Offering expert legal advice on the best ways to recover your funds. - Negotiation with Companies

Direct communication with fraudulent companies to resolve issues amicably and retrieve funds. - Legal Action

If negotiations fail, Sari Office takes necessary legal steps and follows up on lawsuits to ensure justice.

Tips to Avoid Falling Victim to Fraudulent Trading Companies

- Verify Licenses

Always ensure the trading company is licensed by recognized regulatory bodies in the UAE, such as the Securities and Commodities Authority. - Research the Company’s Reputation

Read reviews and check previous investors’ experiences with the company. - Beware of Unrealistic Promises

Be cautious of promises of massive profits in a short time, as these are often unrealistic and misleading. - Consult Experts

Before investing, seek advice from financial or legal experts to confirm the company’s legitimacy.

Key SEO Keywords for This Context

- Recover funds from fraudulent trading companies

- Fraudulent trading companies in the UAE

- Sari Office for fund recovery

- Protecting beginner investors

- Avoiding trading scams

Conclusion

Falling victim to fraudulent trading companies can be a painful experience, especially for beginner investors. However, recovering funds is now possible thanks to experts like Sari Office. Always verify the credibility of trading companies before investing and follow the necessary legal steps if you fall prey to fraud. Remember, prevention is better than cure, and awareness and knowledge are your first line of defense against fraudulent schemes.

Useful Resources

- Securities and Commodities Authority – UAE

- Trustpilot – Reviews on Trading Companies

- How to Recover Funds from Trading Scams

By following these guidelines and leveraging the services of specialists, you can protect yourself and your investments from fraudulent trading companies.