introduction

The Forex market is a global trading market that allows investors to buy and sell foreign currencies. One of the popular strategies in Forex trading is making use of leverage. Leverage allows traders to trade with a larger amount of capital than they actually have. In this article, I will review the most popular currency pairs in the Forex market that can be used with leverage.

Major currency pairs

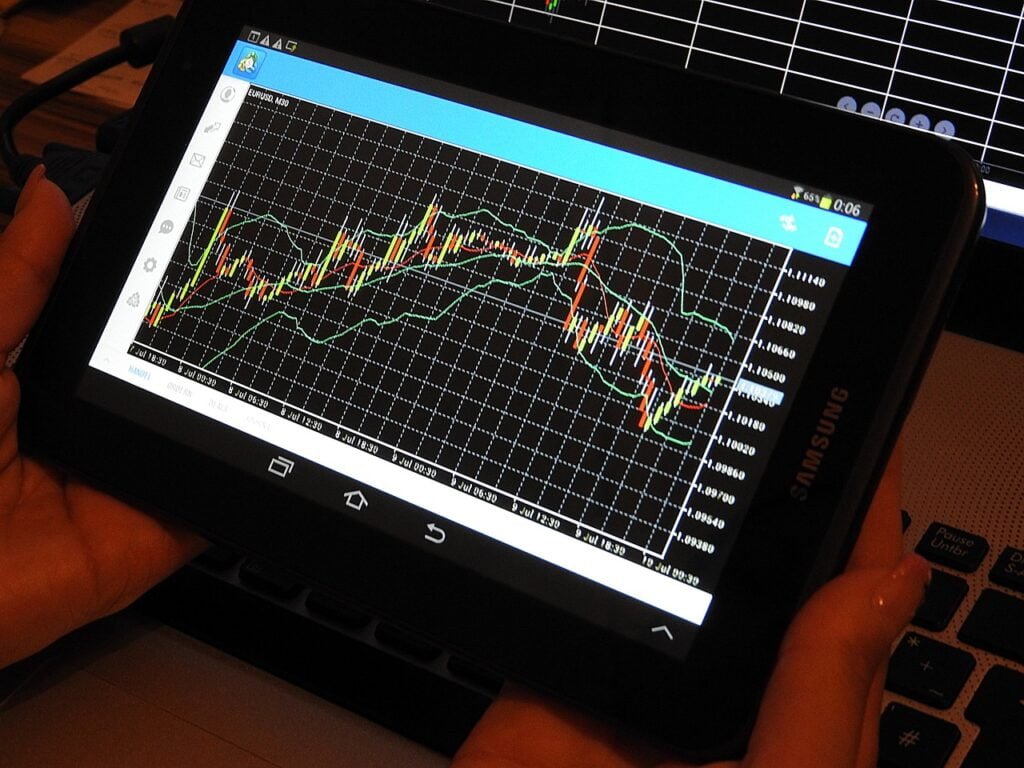

Major currency pairs are those that include the US dollar as one of the currencies traded in the pair. Some of the major currency pairs include EUR/USD (Euro vs. US Dollar) and GBP/USD (British Pound vs. US Dollar). These pairs are considered among the most traded pairs in the Forex market due to their high liquidity and good volatility that can be exploited.

Small and independent currency pairs

In addition to the major currency pairs, there are also minor and independent currency pairs that can be used with leverage. Some smaller, independent currency pairs include AUD/JPY (Australian dollar vs. Japanese yen) and NZD/CAD (New Zealand dollar vs. Canadian dollar). Although the trading volume of these pairs may be somewhat lower, they may provide good profit opportunities thanks to strong fluctuations.

Exotic currency pairs

Finally, there are exotic currency pairs that include currencies that are less common in the Forex market. Examples of rare currency pairs are USD/SEK (US dollar vs. Swedish krone) and USD/NOK (US dollar vs. Norwegian krone). Although the trading volume of these pairs may be low, they can provide high profit opportunities due to their high volatility.

Ultimately, traders should choose pairs they feel comfortable trading with and understand the risks of leverage. Traders should also take advantage of technical analysis tools and economic news to make informed trading decisions.